|

Featured

Program |

Venture Financing Roundtable

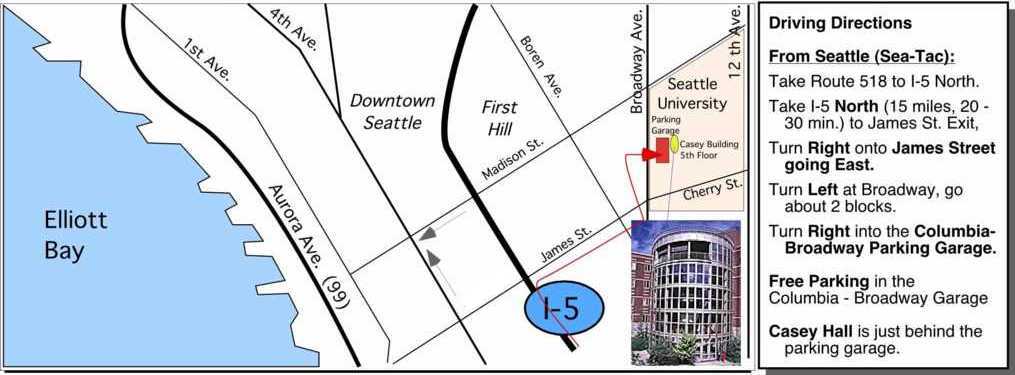

Hosted at Seattle University

|

New Testimonial of the Month

"Rob:

I just want you to know how good your program is.

After having been to many of the investment group meetings around town, which are all valuable,

I've found that yours is the one that's indispensable.

Your speakers are always top of the line, and yours is the only program trying to make sense out of the investment process by engineering it,

in effect. Many thanks to you and your staff for your intelligent and tireless work."

- Warren Chapman

- President, Scrutiny, Inc.

Click for More

Testimonials

Program

Calendar

Coming this spring!

2004 Roundtable Dates!

May 18, 2004

June 1, 2004

June 15, 2004

Live Venture Consulting!

Investors + Entrepreneurs

|

|

|

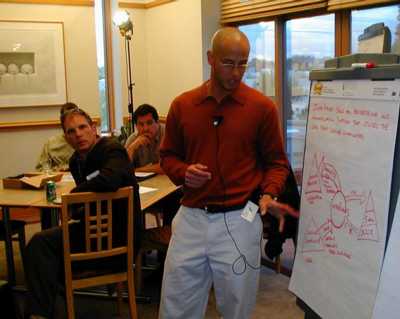

The Venture Financing Roundtable

Last Tuesday's program featured Kevin Cable of Cascadia Capital LLC,

and Martin Tobias, of Ignition Partners.

These two experienced investors demonstrated one of the best choreographed performances to date, with an integrated straight-shooting presentation

with many entertaining moments.

Last Tuesday's program featured Kevin Cable of Cascadia Capital LLC,

and Martin Tobias, of Ignition Partners.

These two experienced investors demonstrated one of the best choreographed performances to date, with an integrated straight-shooting presentation

with many entertaining moments.

Martin gave us a first hand account of what it means to take VC dollars, use that capital to go through the IPO process.

Kevin walked us through the M&A process for entrepreneuers who choose the acquisition path to liquidity, versus IPO.

Entrepreneurs received direct, candid feedback on their business model diagrams.

Contact us if you would like to see the full presentation on

video.

Coming Tuesday,

May 4, 2004

Register Now - 3 Great Speakers

"Secure Your Legacy"

- Financing and building successful companies and subsequent

wealth management strategies for startup executives

Chuck Hirsch, Madrona Venture Group

Jeffrey Mullen, Morgan Stanley

Kurt Olson, Fahlman & Olson

Guest Host: Warner Wong, former director, WSU SBDC

Guest Host: Warner Wong, former director, WSU SBDC

Live Venture Consulting: 5:30 to 7pm "on the

white boards"

Speaker Presentations: 7pm to 9pm

This presentation will highlight the tactical elements of building great companies and the legal and analytical dimensions of subsequent wealth management for early stage companies and entrepreneurs.

It includes the rare commentary of successful entrepreneur-turned-VC, Chuck Hirsch of Madrona Venture Group.

Chuck will share with us his experiences of his entrepreneurial and management journey, as well as his perspectives from working with innumerable start-ups and successful companies.

Weˆll learn first hand the importance of building successful companies and identifying and securing various financing sources.

He will be joined by two other prominent speakers who will then focus on effective wealth management and how it can be the critical determining factor of success for capturing wealth for estate planning purposes and the wealth transfer process.

Kurt Olson, attorney, CPA and estate planning specialist with Fahlman & Olson will first review legal considerations surrounding the ownership of the entrepreneur's assets, and structures and strategies employed to derive maximum benefit from the successful exit event, whatever form that event takes. Jeff Mullen, Sr. Vice President of Morgan Stanley will then drill down to the basic tenets of Modern Portfolio Theory and the Efficient Frontier, as they relate to risk/return maximization and more advanced asset class diversification and wealth management techniques.

About: Chuck Hirsch

Managing Director, Madrona Venture Group

Chuck Hirsch, Managing Director, joined Madrona Venture Group in 1999. He serves as board observer for Aventail and ThinkFire. In addition, he has developed and oversees the firm's strategic relationships with Microsoft, IBM, Boeing, Agilent, and numerous others.

Mr. Hirsch was formerly Chairman of Hirsch & Co., LLC, a Seattle-based venture consulting firm. He has advised a number of technology companies as well as several prominent national investment firms. He co-founded and was President of Dare to Dream Intertainment, which was acquired by Microsoft in 1995, where he served as Group Product Planner, co-leading development of the Actimates Í product line. In 1988, he helped to create, and became Executive Vice President of, the Amelior Foundation in New Jersey.

He serves on the Board of Trustees of the Fred Hutchinson Cancer Research Center, the Board of Directors of the Institute for Systems Biology, is a member of the Executive Committee of the Seattle Alliance of Angels and the Advisory Board for the Talaris Research Institute. In 2002, he was appointed by Washington State Governor Gary Locke as a founding member of the Stateˆs Economic Development Commission. A former White House Fellow, Mr. Hirsch is a graduate of Williams College.

About Jeffrey Mullen, Morgan Stanley

Jeff Mullen is a Morgan Stanley Senior Vice President and Portfolio Manager in the Custom Portfolio program. He has been with the firm for 17 years.

His investment group focuses on a complete range of corporate services and integrated wealth management strategies for entrepreneurs, corporate officers,

high net worth individuals and family groups, and foundations and endowments. Jeff is a member of the board of directors and the investment committee of the

Seattle Pacific University Foundation.

He is a graduate of Colby College with majors in economics and administrative science.

About Kurt Olson, Fahlman & Olson

Kurt, an attorney and Certified Public Accountant with Fahlman & Olson, concentrates his practice on trust and estate planning and business law for high

wealth individuals, including counseling clients regarding their closely held business and real estate interests. He is experienced in establishing family

limited liability companies and limited partnerships, insurance and personal residence trusts, family succession and business succession estate plans, and

other strategies to transfer family wealth and reduce federal estate and gift taxes. Kurt taught Business Law for Seattle Pacific Universityˆs MBA program.

He is a member of the Business Law and Real Property, Probate and Trust Sections King County Bar Association, and the Seattle Estate Planning Council.

Programs that feature VCs tend to sell out, so please register in advance.

- Call me if you have questions. - Rob

|

In Partnership with:

|

| |

Venture All

Stars - Coming June 4

VenLogic Supports Venture All Stars

VenLogic provides special Venture Assessment Program for the Venture All Star Participants.

Get ahead by being prepared.

Learn how investors look at your deal - BEFORE you meet them.

Includes:

Includes:

Preview Edition DVD

Venture Financing Roundtable Access

Venture Assessment Workshops Available

VenLogic has advised previous companies who have presented

and successfully raised capital at this program. Partners

since the first program held in 2000. Click here to learn

more >>

Investment Forum

|

Spring 2004 Calendar:

May 18 - Cancelled for client engagement.

June 1 - Northwest Capital Appreciation, Dorsey Whitney

June 15 - Kevin Gabelein, Managing Director, Fluke Venture Partners; Andy Dale, Buerk Dale Victor LLC

Sponsored by:

|

|