|

Featured

Program |

Venture Financing Roundtable

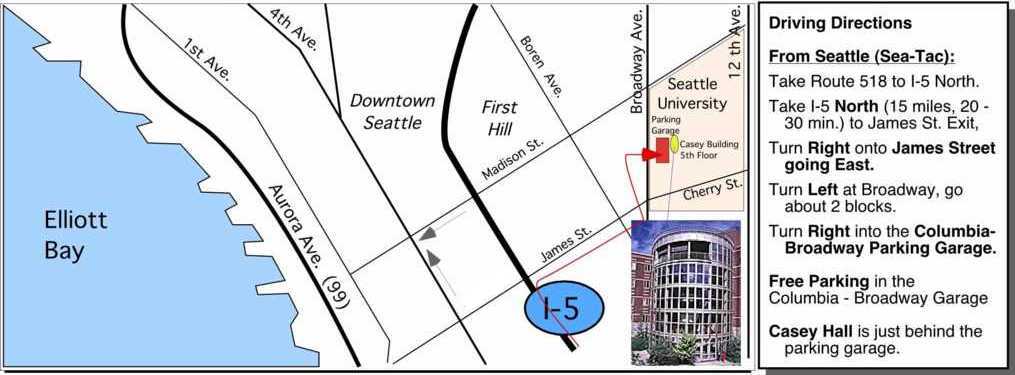

Hosted at Seattle University

|

Testimonial of the Month

"Rob:

Please accept my formal appreciation to you and your staff

for inviting me to the White Board session and Dr. Andrade´s

presentation. I found the White Board session to be a

very powerful experience. A Venture Model for our work

is emerging in ways that I simply had not expected. Please

extend my thanks to your staff members who were so generous

with their time and creativity.

Still, my budget for this activity is dearly restricted,

but your program clearly justifies the investment. Please

add me to the list of attendees for the next session.

Again, thank you for your assistance in helping me articulate

this work."

- Daniel R. Robles

Click for More

Testimonials

Program

Calendar

Coming this spring!

2004 Roundtable Dates!

May 4, 2004

May 18, 2004

June 1, 2004

June 15, 2004

2004 Seattle University

Business

Plan Competition

Winner gets $10,000

Candidates Attend Venture

Financing Roundtable for Expert Coaching & Equity Marketing

Education

Live Venture Consulting!

Investors + Entrepreneurs

|

|

|

The Venture Financing Roundtable

Last Tuesday's program featured Chad Waite of OVP,

and Dr. Perry Fell, of Seattle

Genetics. In a tag-team ad-lib performance, Chad and

Dr. Fell took turns relating their experiences in building Seattle

Genetics from the very inception that required over $37M in

venture financing between the Series A and B rounds, $51M in

an IPO on NASDAQ, for a total of $150M. Time flew by as stories

were revealed of hard, critical decisions that made the ultimate

difference in the success of building shareholder value.

Last Tuesday's program featured Chad Waite of OVP,

and Dr. Perry Fell, of Seattle

Genetics. In a tag-team ad-lib performance, Chad and

Dr. Fell took turns relating their experiences in building Seattle

Genetics from the very inception that required over $37M in

venture financing between the Series A and B rounds, $51M in

an IPO on NASDAQ, for a total of $150M. Time flew by as stories

were revealed of hard, critical decisions that made the ultimate

difference in the success of building shareholder value.

It was abundantly clear that a) not all investors are alike,

and b) the most critical decisions made in the Series A round

carried the greatest, long term impact that has lead to this

outstanding success story. Chad and Perry were most generous

with their time in the pre-session white board exercises advising

one startup, while also staying afterwards to answer questions

that were generated during the presentation.

See Chad and Perry's Video clip.

Get the entire 60 min video here.

Coming Tuesday, April 20, 2004

Register Now - Seats are limited.

Title: Managing Investor

Expectations for an Acquisition

Kevin Cable, Cascadia Capital LLC

Martin Tobias, Ignition Partners

Guest Host: Warner Wong, former director, WSU SBDC

Live Venture Consulting: 5:30 to 7pm "on the

white boards"

Speaker Presentations: 7pm to 9pm

To get funded today, venture investors expect a clear sense

of the exit that will enable them to get their capital back

and post gains to their limited partners. Most entrepreneurs

seeking capital have a sense that a merger or acquisition by

another firm would be the "most likely exit." Investors need

to know that the entrepreneur truly understands what this entails,

for some entrepreneurs may continue to stay with the company after the acquisition while

the investor exits ahead of them.

To get funded today, venture investors expect a clear sense

of the exit that will enable them to get their capital back

and post gains to their limited partners. Most entrepreneurs

seeking capital have a sense that a merger or acquisition by

another firm would be the "most likely exit." Investors need

to know that the entrepreneur truly understands what this entails,

for some entrepreneurs may continue to stay with the company after the acquisition while

the investor exits ahead of them.

Kevin and Martin will give us a first hand account of how to manage investors

expectations for an acquisition.

Their program will cover the following topics crucial to success:

1. Understanding the perspectives of acquirers and investors

2. Evolutions of the capital structure that will affect an acquisition.

3. Process of an acquisition and the dynamic at each stage.

4. Expectations of deal structure, what different things mean.

5. Post transaction integration.

Learn how to successfully raise captial at each round by managing

expectations towards a successful exit.

About: Kevin Cable

Executive Vice President, Founder

Kevin Cable leads strategic development for Cascadia Capital

including PR, marketing, and general business development. In

addition, Kevin focuses on development of regional relationships

for the firm throughout North America. Kevin plays a critical

role in the identification of prospective opportunities across

the firm's investment banking focus areas: corporate finance,

mergers & acquisitions, strategic advisory services, and capital

market services. He brings deep operational experience, having

served more than 14 years on the executive teams of several

technology companies, including Numera Software, which he co-founded

and led as CEO. Kevin has served as a director of the Washington

Software Alliance, the Alliance of Angels, and several private

technology companies. Kevin holds a B.S. in Cell and Molecular

Biology from the University of Washington.

About Martin

Martin is an Ignition Venture Partner. He works on Ignition's infrastructure software investments.

Prior to Ignition, Martin spent more than 15 years in operating roles in technology companies, including four years at Loudeye Technologies and six years with Microsoft.

Martin was the CEO of Loudeye Technologies Inc, which he founded in 1997 and took public in March of 2000. Through his leadership, the company grew to be one of the largest providers of audio and video enabling solutions for the Internet. Martin developed many strategic partnerships and customers including Microsoft, Real Networks, NBC, CBS, AOL, Universal, Sony, Warner Bros. and EMI.

Prior to founding Loudeye, Martin spent six years with Microsoft where he played a key role in the launch of Select 3.0 (the volume licensing program for corporations) and developed the company√s channel policies to allow electronic software distribution (ESD). He also led operational projects critical to Microsoft International√s worldwide expansion, particularly in Europe, Scandinavia and Australia.

Prior to his time at Microsoft, Martin was with Andersen Consulting (Accenture). Martin is an active investor in high tech companies and participates on a number of boards.

Programs that feature VCs tend to sell out, so please register in advance.

- Call me if you have questions. - Rob

|

In Partnership with:

|

| |

Venture All

Stars - Coming June 6

VenLogic Supports Venture All Stars

VenLogic provides special Venture Assessment Program for the Venture All Star Participants.

Get ahead by being prepared.

Learn how investors look at your deal - BEFORE you meet them.

Includes:

Includes:

Preview Edition DVD

Venture Financing Roundtable Access

Venture Assessment Workshops Available

VenLogic has advised previous companies who have presented

and successfully raised capital at this program. Partners

since the first program held in 2000. Click here to learn

more >>

Investment Forum

|

Spring 2004 Calendar:

May 4 - TBD

May 18 - TBD

June 1 - Karen Huh, IDG Ventures

June 15 - Kevin Gabelein, Managing Director, Fluke Venture

Partners

Sponsored by:

|

|