|

Featured

Program |

Venture Financing Roundtable

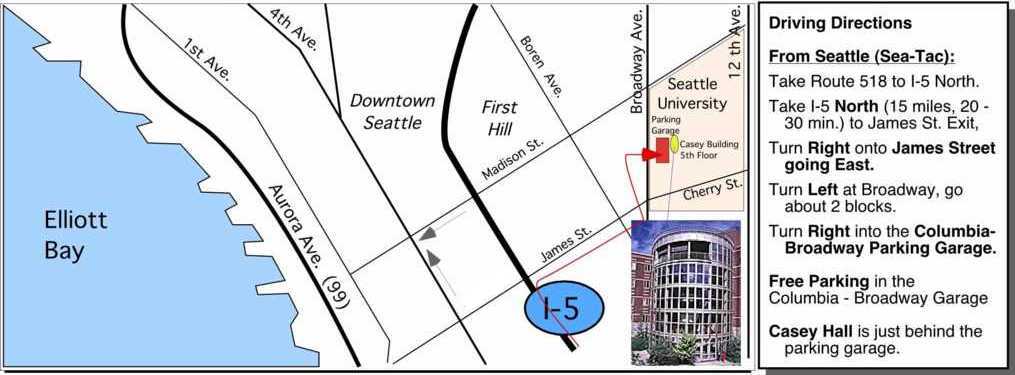

Hosted at Seattle University

|

Testimonial

of the Month

"Rob:

I just want you to know how good your program is. After

having been to many of the investment group meetings around

town, which are all valuable, I've found that yours

is the one that's indispensable.

Your speakers are always top of the line, and yours is

the only program trying to make sense out of the investment

process by engineering it, in effect. Many thanks to you

and your staff for your intelligent and tireless work."

- Warren Chapman

- President, Scrutiny, Inc.

Click for More

Testimonials

Program

Calendar

Live Venture Consulting!

Investors + Entrepreneurs

|

|

|

The Venture Financing Roundtable

Our last program featured James Wagar of Northwest

Capital Appreciation and Randy Price of Dorsey

Whitney

Our last program featured James Wagar of Northwest

Capital Appreciation and Randy Price of Dorsey

Whitney

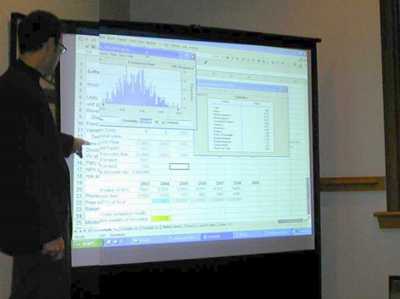

James and Randy investment in developing a coordinated presentation

paid off with room to spare for future programs. They both gave

us a fantastic learning opportunity by walking through the details

of a term sheet by his firm's buy-out fund to acquire 100% of

the stock in a fictional $70M semi-conductor business that had

previously raised 3 rounds of venture financing. The audience

had the opportunity to "take the position of the entrepreneur"

and analyze the financials and terms while James Wagar presented

his term sheet to management. Randy Price demonstrated his deal-making

prowess by offering creative "out of the box" thinking as Securities

counsel with alternative counteroffers that provided depth to

the exchange.

The bottom-line returns to management for building a successful

business became evident, with the calcluations clearly indicating

the power of anti-dilution provisions of the venture capitalists.

Included were the terms surrounding EBITDA, sources of the financing,

Exclusivity, Management Cooperation, and Fees

The bottom-line returns to management for building a successful

business became evident, with the calcluations clearly indicating

the power of anti-dilution provisions of the venture capitalists.

Included were the terms surrounding EBITDA, sources of the financing,

Exclusivity, Management Cooperation, and Fees

It was clear that more time would be required to gain full appreciation

for the sophistication and full analysis of the transaction.

So we look forward to Part II hopefully sometime this Fall.

Contact us if you would like to see the full presentation on

video.

Coming -

Tuesday, June 15, 2004

Register Now - 2 Professional Venture Investors

"Building a VC Syndicate"

- How to build local venture syndicates for Pacific Northwest based growth companies

Andrew Dale, Buerk Dale Victor LLC

Kevin Gabelein, Fluke

Venture Partners II, L.P.

Live Venture Consulting: 5:30 to 7pm "on the white boards"

Speaker Presentations: 7pm to 9pm

Entrepreneurs must conduct astute strategic equity marketing before approaching professional investors.

Everyone saves time and money when the right entrepreneur approaches the best-fit investors for their deal type.

Learning how investors focus is a crucial skill to properly targeting the right investor.

Furthermore, itĂs rare that a single investor will supply the entire funding needs of a company, so they will

undoubtedly be required to develop an investor syndicate in order to raise the total capital required.

It can take years of experience to learn how venture investors focus in a private equity market well enough to be proficient in designing a funding

strategy and syndicate that will stand the test of time. Failing to acquire investor syndication skills can cost millions in the long run.

We have the privilege of having two seasoned venture investors who have similar, but different investment strategies.

We are honored to have each partner describe the following:

Fund investment strategy

VC Syndication as key to Operating as a Small fund in the Pacific Northwest

Why both funds have non-tech investments in their strategy

Case study examples

Entrepreneurs will undoubtedly gain value from learning how to prioritize and coordinate among venture funds that they approach.

The investors will provide case examples which will highlight the discussion and will add context that should enable entrepreneurs to learn how to

make syndicate decisions for themselves. Finally, the investors will close with general advice on how to approach any venture fund when being asked to develop a syndicate.

About Mr. Andrew Dale

Andy serves as Managing Partner and at BDV, a Seattle-area venture capital firm that currently manages $25M under management with investments in 9 companies.

Andy he is responsible for overseeing all firm operations, where he serves as a member of the board of directors for ClearMedical and formerly a board observer for Performant, Inc.,

a BDV portfolio company successfully exited through sale to Mercury Interactive. Andy is also a member of the board of trustees for Seattle Biomedical Research Institute.

Andy was honored as one of the Puget Sound Business JournalĂs top 40 business leaders under the age of 40 for 2003.

He holds an AB from Harvard College and an MBA from the Harvard Business School.

About Mr. Kevin Gabelein

Kevin joined Fluke Venture Partners in 1997 and is responsible for due diligence, deal structuring, and deal-flow generation.

He currently serves on the board of Fios, Inc. Prior to joining FVP, Kevin practiced corporate and securities law in the Corporate Finance Group of Riddell Williams P.S. in Seattle.

Kevin has experience in general corporate representation and a variety of transactions, including seed financings, sophisticated venture capital transactions, and mergers and acquisitions.

Kevin was also a Certified Public Accountant, and practiced with the Seattle office of Pricewaterhouse Coopers LLP.

Kevin received his B.A. in business administration from the University of Washington, and his J.D. from the Southern Methodist University School of Law.

Programs that feature investors tend to sell out, so please register in advance.

- Call me if you have questions. - Rob

|

VFR Summer Break

It's been a great year, with 24

consecutive programs to date. Thanks go out to all of our speakers,

partners, participants and to Seattle University for making

this Roundtable such a great success. It will be a busy summer

working with clients, setting up the Fall calendar, improving

our back office systems, and fine tuning our product and program

design. We will likely hold a program or two, so be sure to

watch for our program announcements. Thank you for your continued

support.

- Rob

|

Sponsored by:

|

Seattle University and the Albers School of Business and Economics Alumni Board

Seattle University and the Albers School of Business and Economics Alumni Board

Presents:

2nd Annual Albers School Golf Tournament!

Friday, July 16, 2004

Trilogy Golf Club

11825 Trilogy Parkway NE, Redmond, WA 98053

See pictures from last year's tournament!

1:00 p.m. Shotgun Start, Best Ball Scramble Format

Hole in One contest - Your chance to win a BMW!

Dinner and Networking after Golf. (Dinner tickets available for non-golfers)

Great prizes, raffle, and a silent auction.

All prizes/action items provided by SU Alums, donors and sponsors.

Register Here

For more information, please call David White at 206.296.5732 or rsvp@seattleu.edu.

Sponsorship opportunities available.

|

|